The world is experiencing unprecedented changes in the workforce, and employers are adapting their benefits strategies to keep up. Organizations are reviewing their retention strategies because providing top-notch benefits is a vital component of creating a company culture that attracts and retains the best talent. Companies are looking to their benefits agents for solutions to help them become an employer of choice.

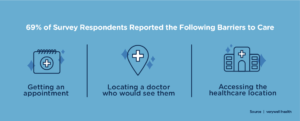

Businesses of all sizes have struggled to provide robust healthcare benefits without having to pass the costs on to employees. In addition to high deductibles and copays, traditional insurance plans can also weigh down a health plan with unlimited claims that impact profits. This is one of the major reasons direct primary care, or DPC, is quickly becoming the foundation of cost-effective health plans.

Direct Primary Care Can Mitigate Claims

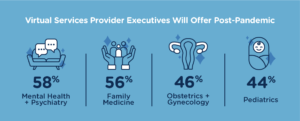

Layering direct primary care into traditional insurance products causes them to perform better and increases employee satisfaction. Because DPC is not insurance, it can be layered into any health plan at any time of the year to begin limiting claims exposure.

DPC shields employers’ health plans, whether it be fully insured, self-insured, high deductible, Minimum Essential Coverage, health share, or others by diverting claims for acute care, chronic disease management, and urgent care away from the plans.

In 2020, Milliman, Inc. published a study called “Direct Primary Care: Evaluating a New Model of Delivery and Financing.” They found DPC members visited emergency rooms 40 percent less over two years. They also reported that DPC members were admitted to the hospital 20 percent less over that same two-year period.1

The study also summarized the overall DPC fee-for-service claim cost savings for a group of employers. Take a look at the savings on this chart for another example of why direct primary care is the go-to strategy to contain health plan costs.2

Primary Care Saves Money and Lives

Primary medical care is so essential that if everyone in the U.S. saw a primary care provider first for care, it would save the U.S. an estimated $67 billion every year.3 Those savings are compelling, but how can that translate into possible savings for employers?

One study found that for every $1 increase in primary care spending, it resulted in $13 of savings in overall health care spending.4 Another study uncovered that people who have a primary care provider save 33 percent on healthcare compared to their peers, who only saw specialists.5

DPC is an excellent solution for employees because of the low monthly membership fee and minimal out-of-pocket costs to visit a primary care physician. It is also a win for employers because it diverts claims away from health plans to protect the bottom line.

Education is Key

Physical wellness and financial wellness don’t have to be mutually exclusive for employees. By giving them a brief overview of the importance of primary care and showing them how easy it is to use their Direct Primary Care benefits, employers can help their workforce stay well while also protecting their own bottom line from absenteeism, presenteeism, and escalating health claims.

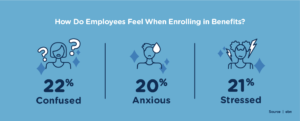

Because employees have been conditioned to believe that traditional health insurance is their only option, they won’t understand how to use a direct primary care membership unless they are educated. When implementing creative plan designs, employee education is key to the success of the health plan.

If you’d like more details about why direct primary care is a necessary component for cost-effective health plans, the e-book 5 Reasons Direct Primary Care is a Top Benefits Strategy is available for download.

If you are looking for more information to deliver to clients, contact Healthcare2U for educational pieces for employers and employee flyers that explain how to utilize DPC.

Sources

- Fritz Busch, Dustin Grzeskowiak, and Erik Huth, “Direct Primary Care: Evaluating a New Model of Delivery and Financing,” 2020, 7.

- Fritz Busch, Dustin Grzeskowiak, and Erik Huth, “Direct Primary Care: Evaluating a New Model of Delivery and Financing,” 2020, 41.

- Stephen J. Spann, MD, MBA, “Report on Financing the New Model of Family Medicine,” NCBI, November 2, 2004, accessed June 23, 2021, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1466777/

- Oregon Health Authority, “Patient-Centered Primary Care,” accessed June 23, 2021, https://www.oregon.gov/oha/hpa/dsi-pcpch/Pages/index.aspx

- Franks, K. Fiscella, “Primary care physicians and specialists as personal physicians. Health care expenditures and mortality experience,” National Library of Medicine, August 1998, accessed June 23, 2021, https://pubmed.ncbi.nlm.nih.gov/9722797/