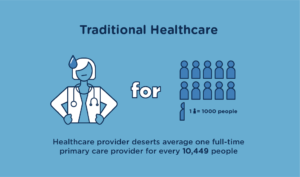

Research shows that fragmented healthcare is twice as expensive as an integrated care approach. This is mostly the result of unnecessary testing and excessive use of medication. With traditional benefits options like insurance, employees and employers bear the weight of these escalating costs.

Direct Primary Care (DPC) provides businesses with a solution that seamlessly integrates with existing benefit plans as a gap solution for group employers or serves as an alternative benefit plan for variable hour employees (including 1099 workers), keeping employer expenses low while diminishing the financial impact of high deductibles and expensive out-of-pocket costs.

DPC utilizes an integrated benefit model to overcome affordability restrictions of modern-day healthcare and to address long-standing accessibility barriers to managing preventative care, chronic conditions, and new health issues in a timely fashion before emergencies arise.

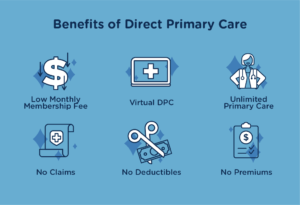

Direct Primary Care is a distinctive healthcare membership that provides:

- Affordability: A no-claims membership coupled with aligned patient/physician incentives drive affordability—enabling employers to offer lower care costs, empower employee health, and deliver better patient experiences.

- Accessibility: Unlimited access to network physicians during business hours; 24/7 access to telehealth specialists; and primary, chronic, and urgent treatment from anywhere reduces patient avoidance and provides peace of mind.

- Transparency: Upfront fixed pricing gives the transparency to empower patients to make smart, budgeted healthcare decisions—preventing post-visit surprise charges or opaque payment responsibilities.

- Mobility: A nationwide footprint drives primary care mobility to better service members while transferring medical records between network physicians for every visit—eliminating care fragmentation and chances for misdiagnosis.

As healthcare costs and care fragmentation increases, employers continue to struggle with expense challenges while patients face long wait periods for acute illnesses, higher copays, and premiums. DPC is a viable solution to these barriers.

Brokers can help fully insured and self-funded employers.

Fully insured employers, self-funded employers, and those who employ variable hour and underinsured staff struggle more and more with these challenges. Benefits brokers can partner with direct primary care providers like Healthcare2U to help employer groups meet the challenges of fragmented healthcare and escalating costs.

Healthcare2U was created to meet these employer struggles and can seamlessly integrate with existing benefit plans already in place, allowing them to easily onboard employees, reduce skyrocketing expenses, and encourage healthy living while preventing disease.

Key Benefits for Brokers:

- Better health outcomes for employees, reducing expenses for employers.

- Provide employers with high-quality, affordable benefits, lowering healthcare costs that help keep employers competitive.

- Establish trust by equipping employers with information to make sound decisions on how to structure a mixture of healthcare memberships and insurance coverage for their employees.

- Achieve level commission to provide an additional resource to fund enrollment teams and educational enrollment information for employees.

Key Benefits for Employers and Employees:

- Gain control of health spend by eliminating insurance claims to offset high deductibles and lower the costs of providing quality healthcare for employees.

- Achieve healthcare price transparency to better budget and make more informed buying decisions.

- Establish and nurture long-term doctor relationships.

- Better health outcomes, improving productivity and reducing employee absenteeism.

- Reduce unnecessary care and build employee trust by aligning the interests between both network physicians and employees

- Offset out-of-pocket costs, diminishing the financial impact of high deductible health plans (HDHPs).

- Accelerate healing with timely access to treatment, reducing waiting periods and lost time.

- Detect diseases and issues sooner, so employees get faster treatment.

Direct primary care is a powerful tool brokers can use to address the pain points of employers large and small. To learn how you can increase commissions and provide top-notch service to clients, contact Healthcare2U.