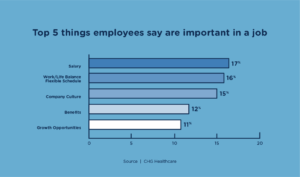

Job seekers now have more bargaining power than ever, and employers are taking a benefits-focused approach to hiring and retention.

Over the past couple of years, the workforce has undergone multiple changes in employee expectations. A renewed focus on health benefits, well-being, and culture has widened the gap between what employees want and what their employers offer. This gap has resulted in higher turnover and a higher risk of losing quality talent. With more than half of US employees considering leaving their current employers, businesses are working with benefits agents to create customizable benefit designs that will attract and retain talent.

Health benefits are more important than ever

According to the CDC, 60 percent of adults have a chronic disease, which accounts for 90 percent of the nation’s healthcare expenditures. Combined with financial challenges brought on by inflation, many workers are looking to their benefits package to help alleviate the financial toll of healthcare expenses. Health benefits are a growing priority for the workforce, with many reporting that they play a vital role in deciding whether to stay with their company or move on to a new one. In fact, 60 percent of employees said health benefits were an important reason to stay with their current employers. Regarding job opportunities, 48 percent said health benefits were an important reason to join a new company. The same study found that when benefits met employee needs, employers saw a 30 percent boost in retention.

Employers are enhancing their benefits to remain competitive

Fortunately, most employers have noticed this renewed interest in health benefits and are now looking to enhance their benefits offerings for 2023. One popular enhancement employers are considering is virtual care solutions beyond traditional telemedicine, with 40 percent planning to offer a virtual primary care network or service. This benefit will be well received by many job seekers and existing employees— especially those with chronic conditions. Another concern for employers is part-time and contract employees, who are likelier to switch jobs for a slight pay increase. A fifth of large employers have begun to focus primarily on benefits packages for this audience. As these employers review their benefits, they’ll be looking to their agents to provide new solutions that are cost-effective and customizable.

An alternative benefit that fits today’s workforce

New problems require new solutions, so employers need to explore alternatives to traditional health benefits. One potential healthcare solution for these groups may be implementing a Direct Primary Care (DPC) membership. With a direct primary care organization like Healthcare2U, employers can provide virtual primary care and unlimited in-office visits nationwide to full-time, part-time or contract employees. These benefits fall under the monthly membership fee, so no claims are generated or submitted to the employer’s health plan.

Health benefit design is critical to recruitment and retention efforts, so benefits that can seamlessly integrate with existing health plans are vital. DPC memberships are flexible, maximize cost savings, and greatly enhance existing health plans, like High Deductible Health Plans (HDHPs), Minimum Essential Coverage (MECs), Self-Funded, and Level-Funded plans. Part-time and contract workers are also eligible for membership at any time of the year, even if they don’t qualify for the company’s health plan.

On top of all these advantages, Healthcare2U’s DPC membership includes a concierge element. Members who are sick or need care call our Patient Advocacy Line (PAL), and our bilingual Patient Advocates navigate them through their care options and next steps.

Contact us today if you’re looking for a product that addresses the evolving needs of today’s workforce and provides concierge-level care to members nationwide.