In the latter part of 2021, Sara R. Collins, Ph.D., vice president, health care coverage and access, for the Commonwealth Fund testified before the U.S. Senate Committee on Finance regarding the escalating costs of health insurance in America. Collins concluded, “The cost burden in commercial insurance is an enduring problem in U.S. health care that is undermining America’s overall economic well-being.”

According to the Health Care Cost Institute, people with employer insurance spent almost 22 percent more between 2015 and 2019. This growing expenditure outpaced both inflation and GDP growth during the same period. With average salaries only increasing at a rate of about 3 percent annually, a rate that already trails inflation on its own, many are concerned about the cumulative effect on Americans who struggle to afford expensive insurance premiums and deductibles as well as the large segment of the population who have been priced out of having any coverage at all.

Inflation Wipes Out Real Gains

Labor market experts warn strong inflation could lead to greater demand from workers and unions for a cost-of-living adjustment in 2022. The Federal Reserve Board says inflation has increased significantly and will likely remain elevated in the months ahead before adjusting. Labor markets continue to churn as people change jobs in search of higher salaries to make up the difference. According to ADP Research Institute, most workers average an almost 6 percent salary increase when changing positions.

PayScale reported 51 percent of workers believe they are paid below market; and workers who believe they are underpaid are more likely to seek new opportunities in the next six months as pay perception has a quantitative impact on retention.

The Commonwealth Fund Proposals

Another key component of employee retention is providing meaningful health benefits. The Commonwealth Fund outlined several proposals to contain health insurance costs in testimony before the U.S. Senate Committee on Finance. Two of the key recommendations were:

- Reduce deductibles and out-of-pocket costs in Marketplace plans.

- Address the high commercial provider prices that are the primary driver of employer premiums and deductibles.

While it’s difficult for most to agree on the proper measures to remedy the healthcare crisis, there are some cost-containment methods that are readily available on the market. With a little education, employers can learn how to incorporate products like direct primary care (DPC) into their health plans for better access to healthcare at lower costs.

Transparent Costs

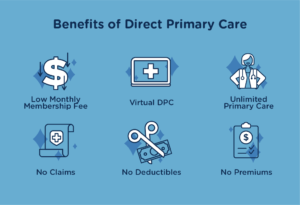

Direct primary care is a monthly healthcare membership that gives members access to unlimited primary care for a low monthly fee. This eliminates expensive premiums and deductibles because DPC is not health insurance. Most DPC plans offer virtual visits or telehealth at no out-of-pocket costs as well as in-office visits for a minimal copay or no out-of-pocket expense.

In addition to mitigating healthcare costs for employees, direct primary care also saves employers money. DPC minimizes claims that could be generated from insurance policies when workers visit doctors. The beauty of DPC is it can be incorporated alongside a HDHP, MEC, or any other insurance plans as a cost-containment strategy. It can be implemented any time of year, so you don’t have to wait for an open enrollment period.

If you’d like more information on using direct primary care to make healthcare more affordable, contact Healthcare2U.